Employee Payroll Template

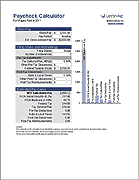

As a new employer, I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. But, instead of integrating that into a general payroll calculator spreadsheet, I have an accountant process my payroll and I use a Payroll Register spreadsheet like the one below to keep a record of employee information, payroll payments, and hours worked. See below for more info.

Employee Payroll Register Template

for Excel and Google SheetsDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

Description

This Employee Payroll Register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like Intuit.com or Paychex.com). I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more columns.

The Employee Payroll Information worksheet is where you would record information like name, ID, address, sex, occupation, hire date, salary or wage basis, exempt status, federal allowances, and other information about current deduction and contribution elections.

The Payroll Register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, FICA taxes, and other deductions.

Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it.

There may be specific record-keeping requirements that apply to you, so check with your accountant to make sure that you are keeping appropriate records.

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Using the Payroll Register

Recording Daily Hours Worked

In the Payroll Register worksheet, columns E-K (Daily Hours Worked) are hidden by default, because if you are keeping a record of employee timesheets elsewhere, you may not want to duplicate that information in the register.

Recording Regular Pay, O.T. Pay, and Reimbursements

If you want to record payroll payments broken down into regular pay, overtime pay, and reimbursements, you can unhide Columns R-T and then make the Gross Pay column a formula.

Payroll References and Resources

- IRS Publication 15 (Employer's Tax Guide) (.pdf) at www.irs.gov - The official source for information about payroll taxes in the US.

- Record Keeping Requirements for Employers at www.dol.gov

- Learn Payroll Basics at payroll.intuit.com - A pretty good summary of payroll requirements and options, but obviously biased towards the use of Intuit's service.

- American Payroll Association at AmericanPayroll.org - A great source of information for everything payroll related.