Expense Reimbursement Form Templates

A reimbursement form is used by most businesses and non-profit organizations. A new employer will soon realize they need a way to reimburse employees for general business expenses like office supplies, mileage, software, training fees, etc. For travel, you can use the Travel Expense Form or Mileage Tracker, but for these other expenses, a general reimbursement form will suffice. All you need is a simple spreadsheet for this type of form, so our Employee Expense Reimbursement Form below is just the thing. I have also added a new printable PTA Reimbursement form.

Employee Expense Reimbursement Form

for Excel, OpenOffice, and Google SheetsDownload

⤓ Excel (.xlsx)Other Versions

License: Private Use (not for distribution or resale)

Author: Jon Wittwer

Description

This reimbursement form was designed to allow employees to request reimbursement for general business expenses.

For travel-related expense reimbursement, use the Travel Expense Report. If you routinely use a vehicle for business purposes, download our Mileage Tracking Log.

Reimbursement Form with Receipts

for ExcelDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

Author: Jon Wittwer

Description

Including digital receipts with reimbursement forms is becoming increasingly popular. Attaching electronic scans or photos of your receipts along with your form via email is an option. But, with this template you can insert images of your receipts below the form. Then you can print the form with the included receipts as a single PDF file.

New for Google Sheets: Google Sheets allows you to insert images into cells, so this could be done with receipts. However, GS currently doesn't have a great way to easily view larger versions of the images within cells. This template uses a separate worksheet to allow viewing the larger versions of the images.

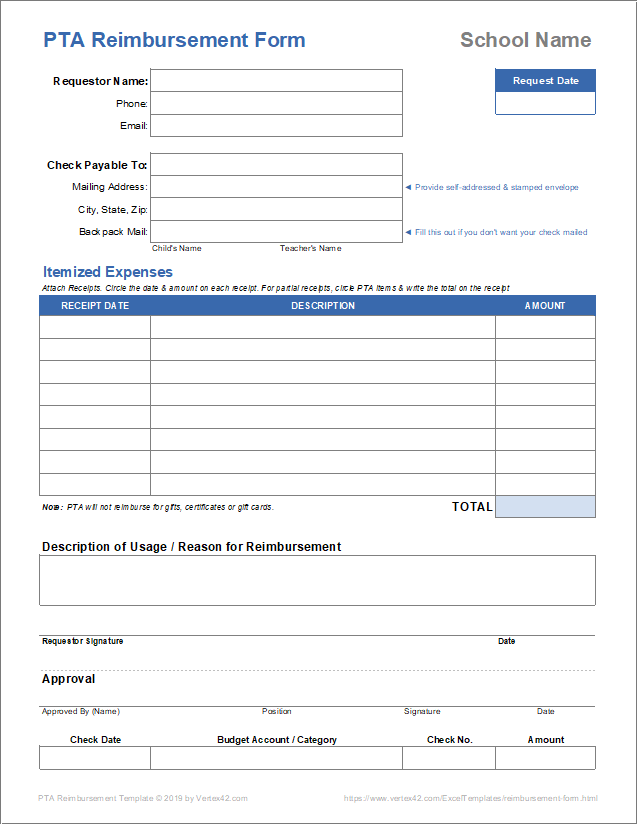

PTA Reimbursement Form

for Excel and Google SheetsDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

Description

My wife was PTA treasurer this year (2018-2019), so we based this form on how our school's PTA handles reimbursements. You can use this form to create a printable reimbursement form for your PTA, PTO, or similar organization.

How to Reimburse Employees for Business Expenses

For Employers

- Customize the Template: Start by customizing the reimbursement form template with your specific information. Ensure that the list of expense categories is relevant and up-to-date. Include a note about current mileage rates, which can be found on the IRS or GSA websites below.

- Establish Reimbursement Criteria: Clearly define what types of expenses are eligible for reimbursement. This helps avoid misunderstandings and potential disputes. Consider setting limits on certain types of expenses, such as meals or travel. Another common policy is to require an employee to get prior approval for any purchase over $XX.

- Provide the Form to Employees: Give a copy of the customized form to your employees when they need to submit a request for expense reimbursement. Make sure they understand how to fill it out and the importance of attaching receipts.

- Substantiate Expenses with Receipts: Ensure employees know that they need to substantiate (provide evidence to support) expenses with receipts, especially for amounts exceeding $75, as per IRS guidelines. Decide if you want to require receipts for smaller amounts for better record-keeping (some experts suggest including receipts for all expenses).

- Process Payments: For accounting purposes (assuming you are using an "accountable plan" - see IRS Publication 463), I find it simpler to write a separate check than to include the reimbursement in a payroll check. Employees may appreciate being reimbursed as soon as possible, instead of waiting for the normal paycheck. Clearly mark the check as "Expense Reimbursement" in the memo field.

For Employees

- Complete the Reimbursement Form: For each expense, choose an appropriate category. If you have questions about how to use the form, ask your employer.

- Attach Receipts: Attach copies of all receipts to the reimbursement form. For digital submissions, scans or photos of receipts are usually acceptable. Keep copies of all your receipts and the completed form for your own records.

- Business Meals: For business meals to be tax-deductible, there must be a clear business purpose, along with a receipt. You might include the purpose for the meal in the Description if you are listing many items on a single form.

- Submit the Form: Follow your company's procedure for submitting reimbursement forms, whether that is through email or a physical copy. Do this promptly to avoid delays. The longer you wait, the more likely you'll forget or lose your receipts.

General Tips

- Discuss Approved Expenses: Employers and employees should regularly discuss what expenses are eligible for reimbursement to avoid any confusion.

- Set Clear Policies: Both parties should understand the company’s policies on expense limits and the types of expenses that require prior approval.

- Use Per Diem Rates: Consider using per diem rates for expenses like meals and lodging to simplify the reimbursement process. These rates can be found on the General Services Administration website.

References

- IRS Publication 463 (Chapter 6) at irs.gov - How to Report Expenses (information for both employees and employers)

- Mileage and Per Diem Rates at www.gsa.gov - U.S. General Services Administration website providing mandated rates for mileage reimbursement and per diem.

- Standard Mileage Rates at www.irs.gov - The IRS's table for employees and self-employed individuals.