Personal Financial Statement Template

Creating and maintaining your own Personal Financial Statement is useful for 4 main purposes: (1) Gaining a good financial education, (2) Creating and evaluating your budget, (3) Applying for business loans, and (4) Applying for personal loans.

If you already know why you need one, and why you want to use Excel to create one, then go ahead and download the template below. If you'd like to learn more about it, continue reading this page.

Personal Financial Statement

for Excel and Google SheetsDownload

⤓ Excel (.xlsx)License: Personal Use (not for distribution or resale)

Author: Jon Wittwer

If you would like to use this Personal Financial Statement in your business to assist your clients, you may purchase the commercial-use version.

Return Policy: 60 Days

License: Commercial Use

Description

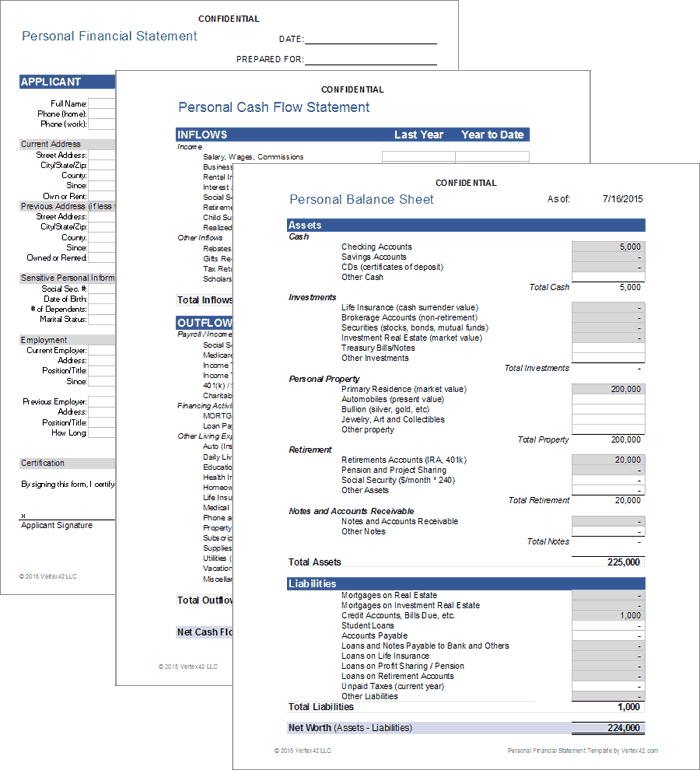

This spreadsheet allows you to create and update an all-in-one personal financial statement that includes:

- Personal Balance Sheet - for listing assets and liabilities and calculating net worth.

- Cash Flow Statement - for listing all your inflows and outflows and calculating your net cash flow.

- Details Worksheet - for listing individual account balances and the details for your properties and loans.

- Info Sheet - for listing contact info that is typically required in loan applications (e.g. names and addresses of the applicant and co-applicant).

It also includes calculations for some common financial ratios:

- Basic Liquidity (BLR) Ratio = Total Liquid Assets / Total Living Expenses :: How many months can you live on your liquid assets without any income? This ratio uses info from both the balance sheet and the cash flow statement. It's one of the really cool things that your PFS can tell you.

- Debt-to-Income (DTI) Ratio = Annual Debt Payments / Annual Income :: A ratio commonly used by lenders to determine how risky of an investment you will be. It should be below about 35% to be considered to have an acceptable level of debt. This comes from the cash flow statement.

- Debts-to-Assets Ratio = Total Liabilities / Total Assets :: Indicates the degree of leverage that is used by a person or company to finance their assets. The higher this ratio the less financial flexibility you have. This comes from the balance sheet.

Why is a PFS useful for creating and evaluating a budget?

If you have already created and follow a budget, your PFS is basically half done. A personal cash flow statement is almost exactly the same thing as a budget, except that a budget is a plan or projection, and your cash flow statement lists your actual earnings and expenses.

A cash flow statement helps you create your budget. Your budget helps you plan how you are going to allocate your net cash flow (hoping of course that your net cash flow is positive).

Why does a PFS help you increase your financial education?

Did you already know the relationship between a cash flow statement and a budget? It's not that the PFS is going to teach you directly. The point is that to accurately complete your personal financial statement you are going to need to ask a lot of questions, and probably do a lot of Google searching, to figure out why such-and-such is a liability, or what exactly is an asset, etc.

Using the template will give you a big head start, but don't assume that everything I've included in the spreadsheet is 100% correct or that it is organized optimally for your needs. Use it as a template - it is just a framework to help you get started. Verify all formulas and make sure you understand exactly how things are calculated.

Why is a PFS used in applying for loans?

A lender needs to evaluate the risk of lending money to you. One of the ways they do that is by analyzing your income and how much debt you currently have. They can get that information from your personal financial statement.

If you are applying for loans, banks will likely have their own personal financial statement (PFS) forms for you to fill out (I've linked to a couple in the references at the bottom of this page). But, if you are already maintaining your own PFS in Excel, then that will make the process MUCH easier.

The Personal Balance Sheet

Step 1: List all your Assets

An asset is something that you own that has exchange value. You may really love your pet rock, but it's probably not an asset. Your financial assets are your cash, savings, checking account balances, real estate, pensions, etc.

Watch out for the cells that are highlighted gray. These are values that come from the Details worksheet. If you overwrite the formula, you'll need to fix it.

Click on the links labeled "Schedule 1" or "Schedule 2" to go directly to the spot on the Details worksheet for entering those assets.

Step 2: List all your Liabilities

Liabilities are your debts and other unpaid financial obligations. Future expenses such as fuel for your car are not liabilities, but unpaid bills are.

Step 3: Calculate Net Worth = Assets - Liabilities

The full market value of your home is an Asset. The amount you still owe on the mortgage is a Liability. The difference is what you call call Home Equity. In a typical business balance sheet, the terms Owner's Equity or Shareholders Equity are the same as Net Worth: Owner's Equity = Assets - Liabilities.

The Personal Cash Flow Statement

Step 1: List all your Inflows

Inflows include all sources of income (wages, dividends, etc.) and whatever else puts money in your pocket.

The Inflows are grouped into "Income" and "Other Inflows", because some financial ratios are based on "Income" and not all inflows are necessarily considered income (such as tax returns, reimbursements, or gifts). You'll need to decide what should be considered income, perhaps by consulting with your accountant.

If your home or stocks increase in value, there is no cash inflow until you sell them. So, realized capital gains (the profits from the sale of property) are inflows, but unrealized capital gains (the gain in value of unsold property) are not.

Step 2: List all your Outflows

Categorizing your outflows is important if you want to calculate certain financial ratios. For example, the "Payroll Deductions" category consists of things deducted from your paycheck. The net income used by the Debt Service Ratio is your gross income minus these deductions.

Why aren't insurance premiums listed under payroll deductions? You can list them there if you want to. But, if you didn't have any income, you would still want to have health insurance, so I find that including health insurance under living expenses is more convenient for calculating the "Total Living Expenses" used by the BLR ratio.

The "Financing Activities" category of outflows is used to determine your total debt payments. That total is used by the debt-to-income ratios. For these ratios, the mortgage payment includes the escrow payment (property tax and insurance) in addition to interest and principal.

Step 3: Calculate Net Cash Flow = Outflows - Inflows

One of the first things you need to learn about personal finance is how to calculate your net cash flow. That is simply the sum of all your inflows (wages, investment income, gifts, and whatever else puts money in your pocket) minus the sum of your outflows (everything that takes money out of your pocket).

References and Resources

- SBA PFS Form (PDF) at www.sba.gov - This is an example PFS used when applying for an Small Business Association (SBA) loan.

- Cash Flow and Budgets at utah.edu - Explains how the cash flow statement and budget are related.

- SCORE PFS (Excel) at www.score.org - This is a fairly simple personal financial statement template for Excel, including only the balance sheet and details for assets and liabilities.