College Budget Template

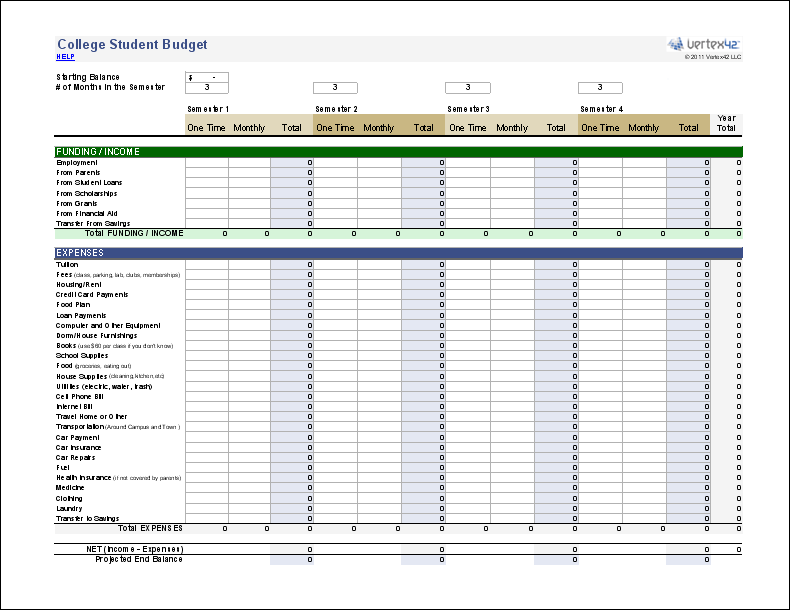

Preparing to attend college can be daunting, especially when it comes to the money. But, with proper planning you can figure out how to make it work. Every college student should put together a college budget plan to determine how they are going to afford their college education. A college student budget should look at all sources of income as well as all expenses. The plan should include not only a monthly budget, but a budget for the semester and the entire year. Use Vertex42's free College Budget Template to help you get started with your college budget planning. Continue reading below for additional tips and information.

College Budget Template

for ExcelDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

Authors: Jon Wittwer and Brent Weight

Description

Are finances keeping you from college? This student budget worksheet will help you with college budget planning for each semester. It includes many school-related expense categories, so you can get a good realistic start on your budget.

A budget is only as good as the information entered into it.

- Make sure that the numbers you are using are accurate.

- Look at past bills for items such as cell phones and memberships.

- Call the college and ask for help.

- The finance/tuition office may have additional information or there may be a student life office with real college students willing to help you.

- Call around and get quotes or details from housing and insurance companies.

Doing all of this is especially important if you are traveling some distance from school as the cost of living may be significantly higher than where you live currently. See the blog article below as well as the College Savings calculator for more information about saving for college.

More College Budget Tips

- After you've created your student budget, STICK TO IT. Track your actual expenses each month and watch your discretionary spending. Try Vertex42's free Money Management Template to help you track your actual expenses.

- Be careful when borrowing for college as the interest can quickly add up.

- Having problems paying for college? Not all your expenses are really required. Are there items you can do without in order to obtain a college degree?

- Get a debit card from a bank close to your college. This will cut down on ATM fees and keep you from borrowing on credit.

- Parents ... use Paypal or bank transfers to help transfer funds to your student.

- Meal plans can be a great value – if they are used. Don't fall into the trap of heavily supplementing your meal plans with groceries or fast food.

- Many students can qualify to remain on their parent's medical insurance. Check with your insurance company for specifics as new regulations are improving the rules.

- Consider purchasing used books rather than new. Better yet, get to know an upper classman and either borrow or "rent" their books.

- Make sure to have a small reserve for emergencies and unexpected expenses.

College Budgeting Resources

- College Budget Worksheet at pbs.org – A walk through guide on budgeting for college.

- Federal Student Aid at studentaid.gov – The federal student aid website with great information on searching and applying for federal student aid.

- Break down of National Cost Averages at collegeboard.com – Provides some national averages for different expense categories if you don't know where to go.

- List of Average College Costs By State at http://allcollege.org/college-costs.htm – A listing of average tuition, room and board costs by state and college type. Great to double check your information.