Line of Credit Calculator

Download a free Home Equity Line of Credit Calculator to help you estimate payments needed to pay off your debt. I generally do not advocate getting a home equity line of credit (see my home equity loan spreadsheet), but if you already have one, the Line of Credit Calculator spreadsheet below may help. It is much more powerful and flexible than most HELOC calculators that you will find online. Although meant mainly for use as a HELOC calculator, it was designed to simulate a general revolving line of credit. If you are a lender looking for a way to track a line of credit, you can try the Line of Credit Tracker.

Line of Credit Calculator

for Excel, Google Sheets and OpenOfficeDownload

⤓ ExcelOther Versions

License: Personal Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Description

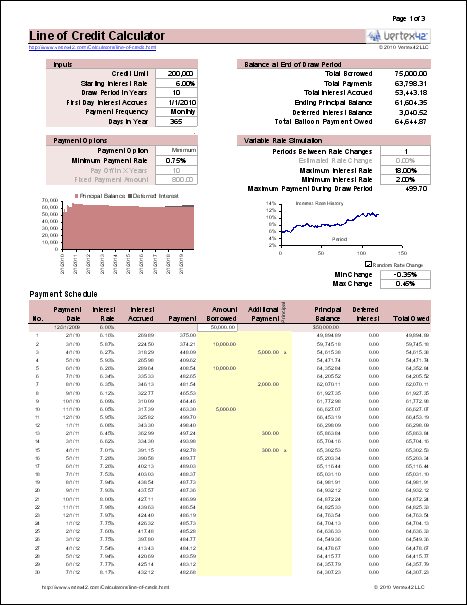

This spreadsheet creates an estimated payment schedule for a revolving line of credit with a variable or fixed interest rate, daily interest accrual, and a fixed draw period.

Features:

- Additional Payments: You can enter additional payments and indicate whether they are principal-only payments.

- Multiple payment options: Select from Amortized, Minimum, Interest-Only, or Fixed Payment options.

- Variable Rate Simulation: Set the rate change to 0 for a fixed rate or choose the random rate change option.

Using the Line of Credit Calculator

There are many assumptions and simplifications built into the home equity line of credit calculator, so don't expect the amounts to match exactly with your bank. Due to the complexity of the spreadsheet, it wouldn't surprise me if the spreadsheet contains errors. Please do report an error if you suspect there may be one, but don't expect the calculations to match exactly.

Read the Cell Comments: Most of what you may need to know about this HELOC calculator can be found by reading the comments identified by the little red triangles in many of the cells.

Tracking Payments: You can manually enter the Payment Date, Interest Rate, and Payment within the table if you want to track your actual payments, by overwriting the formulas. If you do that, you should probably highlight those cells so that you can identify that they no longer contain formulas.

Variable Rate Simulation: This feature of the calculator is not meant to try to predict future rates. Rather, it is designed to help you simulate what might happen if rates increase or fall. The Random Rate Change option can be fun to play with. Press F9 repeatedly to watch how values change.

Home Equity Line of Credit References

- What Should Know About Home Equity Lines of Credit (PDF) at federalreserve.gov - A must-read article. Explains what a home equity line of credit is, how to calculate how much you might qualify for, and things to watch out for.

- What is a HELOC at mtgprofessor.com - Explains how interest is calculated (daily)