Credit Repair Spreadsheet

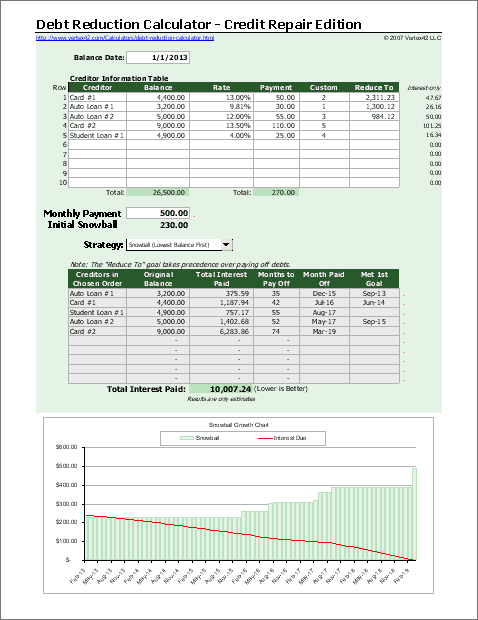

The Credit Repair Edition of our popular debt reduction calculator is designed to help you improve your credit score by using the snowball effect to reduce your credit card balances to specific levels. Why does that help? One of the things that hurts your credit score is to have a high balance compared to your credit limit. Instead of waiting until a card is completely paid off to apply the snowball to the next debt, our spreadsheet helps you reduce your debt in two stages:

Goal 1 - Credit Repair: The debt reduction calculator first uses your extra monthly payment (i.e. snowball) to pay down the credit cards to the balances that you specify.

Goal 2 - Debt Free: After the first goal is met, the snowball is used to pay off your credit cards using the normall snowball approach.

Note: Advertisements listed on Vertex42.com do not indicate endorsements. However, we DO recommend reading references [1] and [2] below.

Credit Repair Spreadsheet

for Excel

Download

⤓ Excel (.xlsx)List up to 10 creditors. A version for listing up to 20 is included with the pro version of the Debt Reduction Calculator

License: Personal Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Description

The new Debt Reduction Calculator - Credit Repair Edition is almost exactly the same as the original debt reduction calculator, so all of the instructions for the debt reduction calculator also apply to the credit repair edition.

The screenshot above is from the commercial-use version. A commercial version for financial advisors or debt specialists can be obtained by purchasing the commercial version of the debt reduction calculator. Contact us for details.

Update 6/13/2018: A bug was fixed that caused #VALUE errors when the extra payments were larger than the balance left on the snowball targets (when the Reduce To values were not zero).

Update 10/19/2023: Instead of entering the Reduce To values manually, you can enter the Credit Limit for each debt and then a single Percent to reduce the balances to a specific % of the credit limit. You could still overwrite the formula in the Reduce To column if you want to enter a specific amount.

Using the Credit Repair Edition

All of the instructions for the debt reduction calculator also apply to the credit repair edition. The credit repair spreadsheet just adds another level on top, and therefore a bit more complexity. Keep in mind that there are many factors influencing your credit score. This spreadsheet specifically has to do with reducing the amount you owe, relative to your credit limits.

Reducing the Amount you Owe: According to reference [3], your FICO® score includes (among many others) the following two factors:

- "Proportion of credit lines used (proportion of balances to total credit limits on certain types of revolving accounts)" [3]

- "Proportion of installment loan amounts still owing (proportion of balance to original loan amount on certain types of installment loans)" [3]

Goal #1, as explained above, is specifically designed to address these two factors.

Reduce To: This is the new column in the credit repair edition that lets you indicate that you want to lower a balance to a specific amount (other than zero). If you left this column blank, the spreadsheet would function just like the original debt reduction calculator.

What Balance-to-Credit-Limit Ratio is Ideal? This is also known as the debt-to-credit ratio or utilization ratio. I have seen conflicting information and there seems to be no one answer. The only thing I can advise is that you seek the help of a professional credit repair specialist. I could say try using a default of 20%, but that isn't always true. See references [1] and [2] below.

Other Notes about using the Credit Repair Edition:

(1) In the summary table, the column "Met 1st Goal" estimates that date when you will have reached the balances entered in the "Reduce To" column.

(2) The strategy you choose for paying off your debt (e.g. highest interest first) will also determine the order that debts are paid to accomplish Goal 1.

How to Improve Your Credit Score

For official information about how to improve your credit score, I would advise reading references [1] and [2] below on www.ftc.gov.

Credit Repair Resources

- [1] Credit Repair: How to Help Yourself at www.consumer.ftc.gov - You definitely need to read this.

- [2] Building a Better Credit Report at www.consumer.ftc.gov - Legitimate methods to fix bad credit (see the Dealing with Debt section).

- [3] How Your FICO® Credit Score is Calculated at myfico.com

- National Consumer Law Center (NCLC) at www.nclc.org

- National Foundation for Credit Counseling (NFCC) at www.nfcc.org