Credit Card Payoff Calculator

Download a free Credit Card Payoff calculator for Microsoft Excel or Google Sheets that will calculate the payment required to pay off your credit card in a specified number of years, or calculate how long it will take to pay off your card given a specific monthly payment. You can also use our new online calculator, but if you want to see exactly how the formulas work, download the spreadsheet.

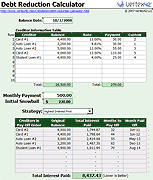

For an even more powerful debt payoff spreadsheet, see our debt reduction calculator.

Credit Card Payoff Calculator

Note: This calculator assumes a constant interest rate, and it does not take into account any late fees, future charges, or cash advances.

Credit Card Payoff Calculator

for Excel, OpenOffice, and Google SheetsDownload

⤓ Excel (.xlsx)Other Versions

License: Personal Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Description

What will it take to completely pay off the balance of a credit card at the current interest rate? Enter your current balance and interest rate. Then, enter a monthly payment to calculate how many months it will take to pay off the credit card, or enter the payoff goal to calculate what your monthly payment must be to meet that goal.

Using the Credit Card Payoff Calculator

The following details explain how the calculator on this page works.

Current Balance: The calculator assumes you are paying off the unpaid principal. If you are actively using a card, then purchases made in the past month usually have a grace period of a month before interest is charged. This calculator does not take into account the grace period for recent charges.

Interest Rate: Unless you know to do otherwise, enter the Annual Percentage Rate (APR). Most APRs will fluctuate over time, and can be affected by late payments and other factors, but this calculator just assumes a fixed interest rate.

Interest-Only Payment: This is an estimate of the monthly interest due, calculated by multiplying the current balance by the monthly interest rate. The monthly interest rate is the annual rate divided by 12. Your monthly payment needs to be larger than the interest-only payment, or you will never pay off card.

The actual credit card interest calculation is usually based on daily compounding, but the monthly calculation is a pretty good estimate. The difference has more to do with the numbers of days in different months rather than the compounding period (although the compound period does have a small effect).

Monthly Payment: If you want to calculate the Months to Payoff, then enter the monthly payment amount. It is a fixed payment, meaning it does not change. It is not a minimum credit card payment, which can decrease over time as your balance decreases.

Part of your monthly payment will be used to first pay the interest due (the Interest-Only Payment amount), and the rest is applied to the principal. This assumes no fees, additional charges or cash advances. The interest portion of the payment will decrease as your balance decreases, but the monthly payment stays the same.

Months to Payoff: If you want to set a goal for when to have your card paid off, enter the number of months instead of the monthly payment. The Monthly Payment will then be calculated.

Total Interest: This is an estimate of the total interest paid by the time the balance is completely paid off and is calculated as Monthly Payment * Months to Payoff - Initial Balance. The total interest is useful for evaluating the cost of debt and comparing different payoff goals. The longer you take to pay off the card, the more interest you will pay. The graphs help show how the total interest decreases as you increase your Monthly Payment.

If you have any questions about how to use the spreadsheet or the online calculator, please contact us.

Steps to Pay off Your Credit Card Debt

Are you trying to escape from the oppression of credit card debt? The following steps may not apply to your specific financial situation, but you may want to consider them ...

- Lower It! Call your credit card company(ies) and ask them to lower your interest rates. If you are considering debt consolidation as a way to lower your interest rates and zero-out your credit card balances, here is my take on debt consolidation.

- Shred It! Stop using your credit card(s). Shred them if you need to. But if you plan to use them again some day, don't cancel them, because that can hurt your credit rating. You can always request a replacement card later.

- Budget It! Evaluate your home budget and cash flow to figure out what monthly payment you can afford. You may need to consider cutting back on spending or working some overtime. Just remember that the faster you can pay off the cards, the less interest you pay in the long run.

- Calculate It! Use the credit card payoff calculator to estimate how long it will take to pay off a card at its present interest rate.

- Pay It! Make your payments religiously, until the balance is zero.

- Sustain It! Just like the tendency to gain weight right after a diet, you may be tempted to rack up a balance on your credit card again. Don't Do It!!! Learn from the past.

Other Online Credit Card Payoff Calculators

Below is a list of online calculators used to check the spreadsheet, and a couple calculators that let you do a bit more fancy calculations.

- What will it take to pay off my credit card? : at Bankrate.com. A simple credit card payoff calculator similar to the spreadsheet above.

- Credit Card Payoff : at dinkytown.net. This calculator lets you also include one or two future purchases, average monthly charges, and an annual fee.

More Debt and Loan Calculators

- Debt Reduction Calculator

- Mortgage Payment Calculator

- Auto Loan Calculator

- Balloon Payment Loan Calculator

- Extra Payment Mortgage Calculator

Resources and References

- 5 Tips for Getting the Most from your Credit Card at FederalReserve.org - Pay on time, stay below your limit, avoid fees, pay more than the minimum and watch for changes in terms.

- Choosing and Using Credit Cards at www.ftc.gov

- Lower Your Credit Card Interest Rate at Bankrate.com - How to lower your rate with a simple phone call.

Disclaimer: This spreadsheet and the information on this page is for hypothetical and illustrative purposes only, and is not meant to be taken as investment or financial advice. Your individual situation is unique, and we do not guarantee the results or the applicability to your situation. You should seek the advice of qualified professionals regarding financial decisions.