Personal Budget Excel Spreadsheet

If you've just entered the real world as a newly independent adult, or if you've been spending more money than you can afford, it's time to figure out a budget. To get started, you can use my free personal budget spreadsheet template in Excel or Google Sheets to track your income and expenses using a common set of budget categories. You can easily change the categories as needed.

If this is your first time trying to create a personal budget, you may want to read the article "How to Make a Budget." It explains how to use a spreadsheet to track your expenses, and then how to turn that information into a budget.

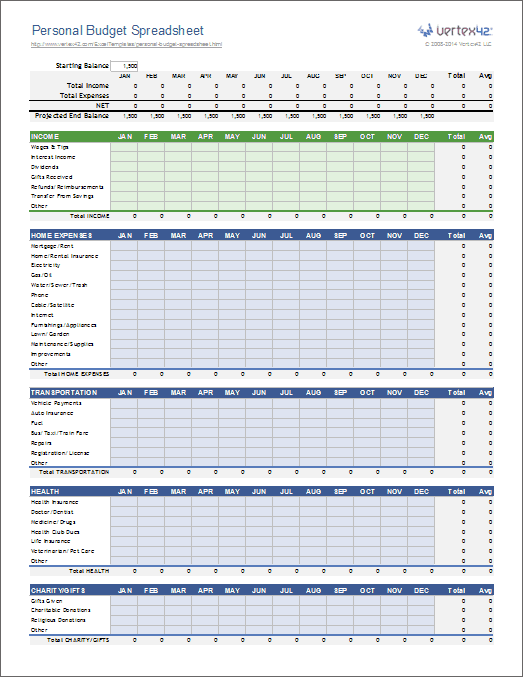

The personal budget spreadsheet below is one of my original budget templates. It provides a simple way to create a budget, especially if you need ideas for budget categories. If you want a more complete system that helps you track, plan, and analyze your spending, try the Money Management Template.

Personal Budget Spreadsheet

for Excel, Google Sheets, and OpenOfficeDownload

Over 1.3 million downloads!

⤓ Excel (.xlsx)► Watch the Demo Video

Other Versions

License: Personal Use (not for distribution or resale)

Author: Jon Wittwer

Description

Like my Family Budget Planner, this personal budget spreadsheet can be used to create a yearly budget. By planning many months ahead, you can account for variable expenses and estimate how major life changes like moving, changing jobs, or purchasing a home may affect your financial future.

For the sake of documenting changes to the spreadsheet over time, here is a screenshot of the older Excel 2003 version:

More Budget Spreadsheets

- Monthly Budget - The monthly version of the above spreadsheet.

- Household Budget Worksheet (monthly) - More detailed and includes child expenses.

- Family Budget Planner - A yearly budget planner, with the same categories as the household budget spreadsheet.

- Home Budget Worksheet - This worksheet provides an alternate way of grouping the budget categories, but works very similar to the template(s) on this page.

Why Use Excel for your Personal Budget?

First reason: it's free. Microsoft Excel isn't free, but if you already own Excel, then you can create a budget without purchasing other budgeting software. If you don't own Excel, then Google Sheets and OpenOffice are free options to consider.

Second reason: flexibility. The reason I use Excel when working with my home and business budgets is that it gives me complete flexibility to keep track of the information the way I want to. For example, I like to use cell comments to explain certain budgeted items in more detail (such as the fact that in May, there is Mother's Day and a couple of birthdays to remember).

Creating a simple personal budget (even if it is only on paper) is one of the first steps to gaining control of your spending habits. Tracking your income and spending comes both before and after making a budget. For expense tracking, you could use my Income and Expense Worksheet, Checkbook Register, or the newer Money Manager. A budget is almost useless without tracking what you are spending.

I started out using Excel to do everything, but I began using Quicken after a friend showed me how easy it was to keep track of checks and credit card charges and download transactions directly from my bank. This isn't an advertisement for Quicken ... it's just a disclosure to say that I don't ONLY use Excel any more.

A spreadsheet may not be the best budgeting solution for everybody. In my opinion, the #1 problem associated with using a spreadsheet for your personal budget is the chance that you'll make errors. The flexibility comes at the price of possibly deleting or messing up an important formula, or making bad assumptions.

If you use and customize any template for your personal budget, make sure you understand how it works and always double-check the formulas. You may learn how to use Excel better in the process.