It's been just over 5 years since I created the free spreadsheet-based Debt Reduction Calculator, and over that time I've received numerous emails not only from individuals who are using it, but also from debt relief firms who are using the spreadsheet to help their clients.

I'd like to use this blog post to provide a place to answer questions and hopefully get you to share your success stories and ideas. More specifically, I'd like to find out what debt reduction strategies people are using.

The Debt Snowball Effect

The debt reduction calculator was designed to simulate the debt snowball effect and allow you to easily select and experiment with different payoff strategies.

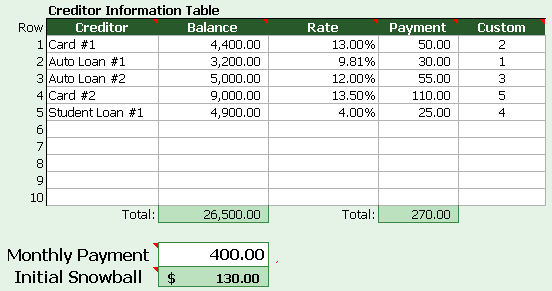

What's the Snowball Effect? Let's say your budget allows you $400 to pay towards your debts (not counting your mortgage in this case). If the total of your minimum loan and credit card payments comes to $270, you are left with a snowball of $130 that you can throw at a debt of your choice.

Let's say you begin by targeting Auto Loan #1 that has a minimum payment of $30. After you pay it off, your new total minimum payment would decrease to $240, so your snowball will increase to $160. Picture a snowball rolling down a mountain picking up speed and increasing in size. That is how the "Debt Snowball Effect" got its name.

Avalanche vs. Snowball

The order that you decide to pay off your debts is very important. It can mean the difference between thousands of dollars. In the example above, the difference between using the Snowball and Avalanche method ends up being almost $3000 in interest.

1. Highest Interest First (Avalanche)

For the mathematically inclined, the fastest way to pay off your debts is using the "Highest Interest Rate First" strategy. Regardless of the balance on the card (and assuming no extra fees), if one charges 10% interest and another charges 20%, you'll pay off the cards fastest by working on the one with the 20% rate first.

Combining the Avalanche Method with paying the bare minimum on all but your currently targeted debts results in the fastest payoff possible.

2. Lowest Balance First (Snowball)

People may get frustrated if they don't see success right away, so throwing a little snowball at your biggest debt might not be the best option. This may be one of the reasons why Dave Ramsey advocates the "Lowest Balance First" method.

If you can knock out a couple easy debts, the psychological momentum of early success can help you stick to your goals.

Play it Smart - Customize Your Strategy

If your highest rates coincide with your lowest balances, then count yourself lucky. You'll get the power of the Avalanche and still be able to see some early success by wiping out the easy stuff first.

You don't need to use these strategies blindly. The Debt Reduction Calculator makes it easy to choose your own order to pay off your debts using the Custom column.

For example, let's say you generally prefer the Lowest Balance First approach but Student Loan #1 has a balance of $4900 at 4% interest, and Auto Loan #2 has a balance of $5000 at 12%.

The Student Loan as the lower balance but if you just swap the order of those two debts, as indicated in the Custom order column (with lowest being paid off first), you'd save about $750 in interest. In my opinion, this is a case where it's better to target Auto Loan #2 before the student loan, even though the student loan has the lower balance.

On the other hand, if you prefer the Avalanche approach but want to experience an early success, you could target Auto Loan #1 first, then proceed Card #2, Card #1, etc. That would decrease the first payoff hurdle from 49 months to 22 months. Of course, you'd also end up paying $1000 more in interest.

Consider these types of opportunity costs when you are deciding on the order to pay off your debts.

There may also be other factors to consider besides the Balance, Rate and Total Interest Paid. I can think of a few, but I'd like to hear what you think (please comment below).

Balance Transfers and Consolidation

A balance transfer involves moving the balance of one credit card, usually one having a high interest rate, to another card that has a lower rate. Perhaps you got some junk mail with a credit card offer of 0% interest for 3 months. Many people jump on the balance transfer bandwagon so that they can afford to continue spending at their current rate, and that just leads to getting into MORE debt. Also, applying for additional credit cards could hurt your credit score.

If you are capable of resisting the temptations and spending that got you into the debt mess in the first place, then a balance transfer may be a legitimate debt reduction strategy. Why? Because reducing the amount of interest and fees that you are paying allows more of your budgeted $500 to go towards paying off the balance due.

If you want to run the numbers, check out the Balance Transfer Calculator.

Debt Consolidation

Debt consolidation is based on the idea of transferring the balance of your debts into a single loan with a lower interest rate. Be a smart consumer and read up on all the pros and cons. See the list of resources in my debt consolidation article.

Debt Snowflaking

The debt reduction calculator has evolved over time as users request different features. Some of the changes were implemented right away because the benefit was obvious. An example of that was adding an "Additional Payment" column to allow a person to include an occasional extra payment beyond their normal scheduled amount. I wrote an article about that a while back titled "What is Debt Snowflaking"?

One of the keys to understanding the effect of debt snowflaking is recognizing that an extra payment towards the principal on a debt is very similar to investing the money. But, paying down debt has some significant advantages. See my article "Debt Payoff: The Best Investment?" for a more detailed explanation.

Emphasis on Credit Repair

Another major update to the debt reduction calculator was the creation of the Credit Repair Edition for the case where the primary goal is improving a credit rating rather than paying everything off as fast as possible. The concept for that is based on the idea that a credit rating has to do with reducing your Balance-to-Credit-Limit Ratio.

So, instead of waiting until a credit card is completely paid off to start applying the snowball to the next debt, you may decide to reduce the balance to 50% of the credit limit and then move on to the next card.

Automation

[Added 8/13/2019] Automation is a strategy that you can apply along with most of these other techniques. The idea is to set up automatic payments on your credit cards and other debts to avoid the risk of late fees.

Using the snowball effect, you are applying your extra payment to usually one debt target at a time, so all the other debts (including the minimum payment on the current target) can be set to autopilot.

Warning: Don't let the balance of your checking or savings account that you are using to make the payments drop too low, or you could incur fees due to bounced checks or overdrafts.

Your snowball payment is not automated. The snowball is an extra payment that you apply to your highest priority debt target. Each month, you will need to look at your plan to see what extra payment you can afford.

You may be able to automate the snowball payment for a time, especially if none of the debts will be completely paid off for a while. But, a debt snowball plan is usually something you are tracking and updating frequently enough that automating the snowball payment may be ineffective.

Should I choose Minimum Payment or Fixed Payment?

When setting up automatic payments, you will usually have the option of either making a minimum payment, or a fixed payment.

The Vertex42 debt reduction calculator assumes a fixed minimum payment for all the debts, to keep the input section as simple as possible. Usually, the amount you enter for the fixed minimum payment would be your current minimum payment that you can get from your credit card statement.

If you choose the Minimum Payment option when you automate your credit card payment, you should be aware that the actual minimum payment usually decreases slowly over time, because it may be based on a percentage of the current balance. It may also be variable because of interest being calculated using a daily rate (and months have different numbers of days). You can see how this works using the Credit Card Minimum Payment Calculator.

If you choose the Minimum Payment option, you will need to update the debt reduction calculator every month (or every few months) to re-sync what you are actually paying with what the debt reduction calculator is assuming. If you don't update it, your snowball payment may not be as large as it could be.

If you want the spreadsheet to more closely match reality, then choose the Fixed Payment option when setting up your automated payments.

If you want to squeeze every last penny you can get from the snowball effect, then make minimum payments and update the debt reduction calculator every month.

For the most part, the minimum payment does not change a huge amount from month to month. So, this isn't going to have a huge effect on your overall debt snowball plan. If you are really curious about that and want to analyze this in more depth, contact me.

What Strategies Do You Use?

Have you been using the Debt Reduction Calculator? If so, please take the time to share your experience. How has the calculator helped you? What strategy or strategies have you used?

Do you have any other questions about how to use the spreadsheet?

Disclaimer: This article is intended for educational and informational use only and not as professional financial advice.

Comments

I got an email today from somebody asking about comparing paying off debt to investing in something like a mutual fund. There are important things to consider besides just comparing interest rates, but if you want to run some numbers to estimate interest gained via an investment, you can use the following savings calculator spreadsheet:

https://www.vertex42.com/Calculators/savings-interest-calculator.html

Comment Update: see the following article:

https://www.vertex42.com/blog/money/debt/debt-payoff-the-best-investment.html

I have been using your spreadsheet for the past few weeks and its great!!! Thanks much!

Anyway to incorporate a 0%, or even better….multiple 0% offers, into the debt calculator to see how it would work to replace higher interest balances on cards?

@Cencal … yes, that would be possible. A column could be added to the Creditor Information Table to specify the number of months for the 0% period. A new “Zero% for n Months” row would then be added in the Payment Schedule under the “Rate:” row to reference the value from the Creditor Information Table. The Interest calculations in the PaymentSchedule worksheet would need to be modified to set the interest to 0 if the “No.” column is within the 0% period. I can send you a copy of the file with this already done if you email me.

Is there a way to expand the sheet to include more than 20 creditors? Unfortunately, I need to expand it to acommidate around 40 creditors.

I have a version that allows up to 40 creditors. Contact me via email if you want me to email a copy. https://www.vertex42.com/about.html

First of all, thank you for the great site you’ve put together, and for making such great spreadsheets available. WhenI found this place I felt i was in spreadsheet heaven. I will make sure to add you to my Facebook sit, i too have a second community account with 4k members which I will make your site available.

Now to my question, do you have anything to manage credits cards as follow:

That would allow me the ability to record, the Creditor, amount owed, interest rate, % to interest and principal paid + remaining balance, due and paid date, as well as Previously paid date and a comment box. Add to that, the ability to archive that information for that month on a different tab for reference.

@Chuck, Perhaps. I’ve been working on something along those lines. Contact me via email (https://www.vertex42.com/about.html) and I can send you a copy of what I’ve got in the works.

Hello,

Is there a way to expand the sheet to include more than 20 creditors? I need to expand it to accommodate around 30 creditors.

Thank you,

Mandie

@Mandie, The extended version lets you download one that can list up to 40.

I just purchased the extended version and am having a lot of trouble opening it in google docs – I have a Mac and this is the only way that I believe I can open it and work with it without having cells and formula’s changing. The website says their is a link to the google docs version, but I’m unable to figure this out. Please help.

@Josh, The link to the Google Sheets version is located on the download page. You can return to the download page via the instructions on the support page. After accessing the Google Sheets version you’ll need to go to File > Make a Copy to save a copy to your Google Drive. If that doesn’t solve things for you, send me an email.

This is great info and well explained, thkans so much! I have been doing this for the past three years and started out with six department store cards, 3 major credit cards, and an auto loan. I’ve paid off one of the major cards and closed it, paid off the car, paid off four of the department store cards, and this month will be able to pay off and close the last two department store cards. That will leave me with two major cards to pay off, only one of which I will keep and pay off in full each month if I use it, which I won’t. This method was so daunting at first but it really works. Time goes by whether we pay these things off or not, and they are betting on NOT, so you have to have a plan. Thanks!

Thank you for creating this site, it’s very helpful.

Thank you for this site. I live by your debt reduction calculator and have referred it to so many people.

using a goal to reach a certain usage amount of any particular credit card based on the APRs they charge so you decide what order you want to work with to reach that usage percentage for that particular card. Example it is said to keep debt to 36% of limits. i’m using 40% to help see which ones to reduce first based on totals, limits, availability, and interest rates being charged. anyway to incorporate some of these variables to be made available in the sheets?.

@Bill, see the Credit Repair version of the debt reduction calculator.