Money Management

Vertex42 provides many different spreadsheet templates to help you manage your money. This part of the blog is for sharing and discussing money management principles including budgeting, debt payoff strategies, and savings goals. You may also find ideas for ways to increase your income. If you are familiar with Excel, check out our templates via the following category pages:

Vertex42 has developed a new Savings Snowball Calculator to help you plan how to reach your savings and debt payoff goals. This article provides some background on the savings snowball concept and explains some of the features of the calculator. Questions and comments are welcome.

Taking a break from Excel tutorials, this article compares paying off credit card debt to investing. Take an in-depth look at interest rates, liquidity risk, limited return, risk of principal loss, and tax efficiency. Perhaps debt payoff is really my best investment.

A place to provide feedback and discuss the new weekly budgeting templates on Vertex42.com.

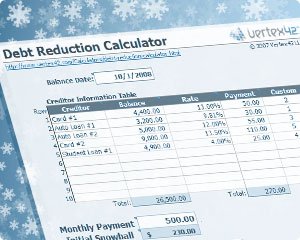

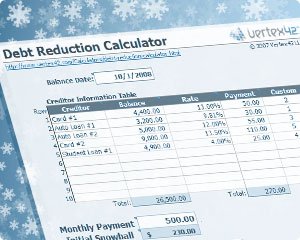

Vertex42’s free Debt Reduction Calculator helps you create a plan for paying off your debts using a variety of different strategies. What strategies have worked best for you?

To help those who are using Vertex42’s budget templates and money management tools, we’ve compiled a huge list of effective ways to save money and help you stick to your family budget.

This article explains how to use the Debt Reduction Calculator to calculate the Monthly Payment that will help you reach your goal of paying off your debt in X number of years or months.

Have you made your new year’s financial resolutions? Many people pledge to do better with their finances around this time of year, but they just don’t know where to start. By guest author, Philip Taylor.

Find out the inside scoop on biweekly mortgage payment plans, how to choose a service provider, and some of the fees to watch for.

If you are interested in getting completely out of debt, paying off your mortgage may be the largest hurdle. Here is a list of strategies for paying off your mortgage early. Most of these strategies can be evaluated using the [...]

So you’re planning the biggest day of your life. This is an important occasion and naturally you want it to be special. But, how do you plan a wedding that isn’t going to start you out financially ruined? You may [...]

Announcement of the new Vertex42 Money Manager – a free powerful Money Management spreadsheet that can be used in place of other money management software.

One way to know if you want to follow a blog, listen to a talk-show, or even become someone’s friend, is to find out if the principles you want to live by match up with the other person. So, here [...]

Snowflaking has surfaced as a new popular term related to debt reduction. I would like to take some time to explain what this means, and how you can add “snowflakes” using the Debt Reduction Calculator. Snowflaking is basically just a [...]