Business Start Up Costs Template

Planning your startup costs is one of the most important steps before launching a business. This free Excel template helps you estimate both one-time startup expenses (like equipment, licenses, and inventory) and ongoing monthly costs (such as rent, utilities, and payroll). Analyzing these expenses ahead of time can help you avoid surprises, secure the right amount of funding, and make smarter decisions as you prepare to open your doors.

To make the process easier, our new template includes an AI Assistant worksheet that can help you brainstorm possible expenses based on your specific business type — especially helpful for costs you might not think of on your own. Whether you're starting a restaurant, franchise, home-based business, or an online shop, this tool gives you a flexible and professional way to plan your budget with confidence.

NEW Business Startup Costs Template

for Excel, with AI AssistantDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

Description

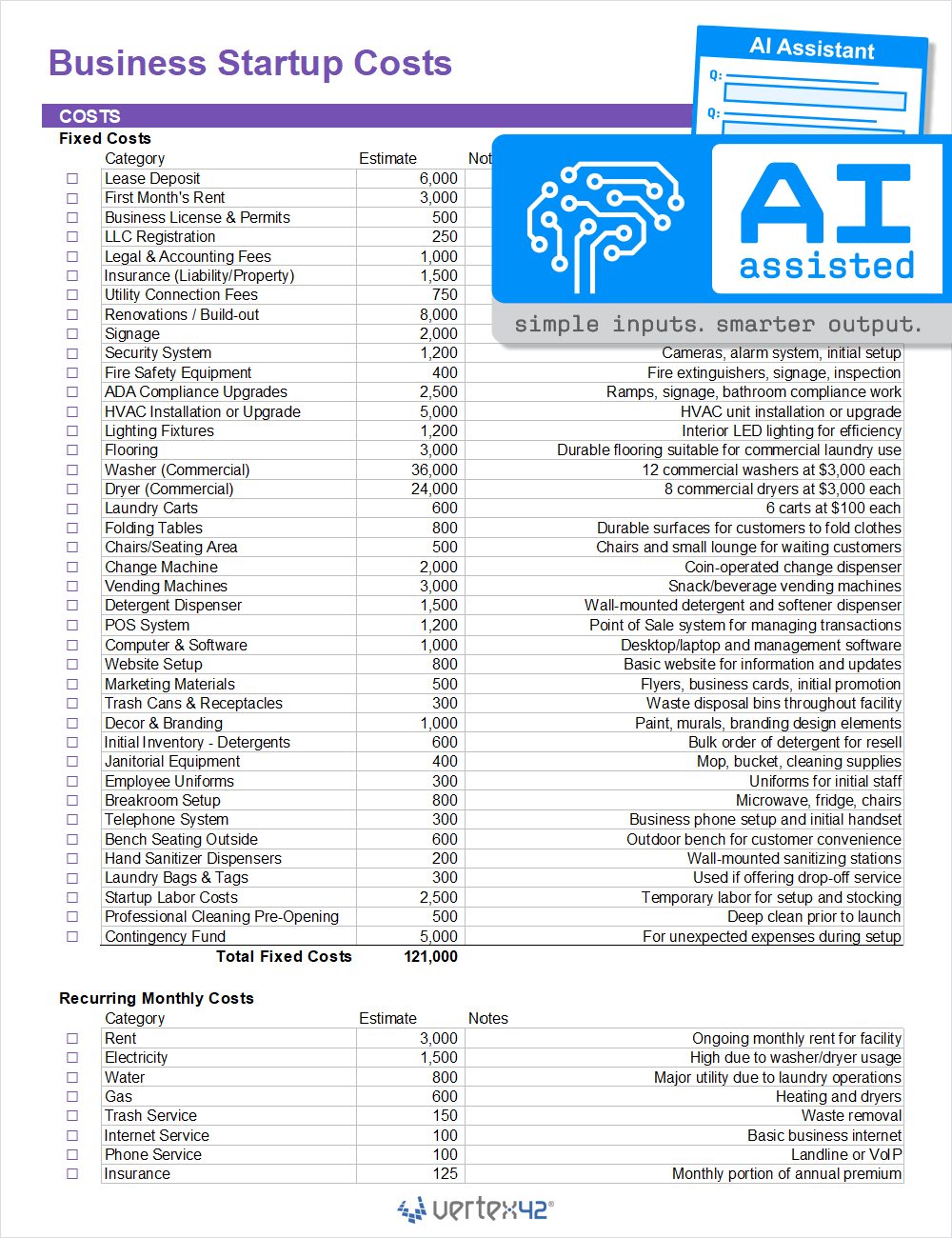

Use AI to help you generate an example set of startup costs specific to your business idea. Answer a few questions about your business, then copy/paste a prompt into ChatGPT.

The example in this screenshot was generated by AI for a Laundromat business.

New AI-Assisted Template: This template was designed to work with AI assistants like ChatGPT to help you brainstorm and analyze your business idea. The file includes an AI worksheet with instructions and a sample AI prompt that you can copy/paste into ChatGPT to help you generate a set of startup costs specific to your business.

Our testing has shown that ChatGPT is often pretty good at coming up with a reasonable set of expenses, some of which we might not have considered otherwise.

Remember that AI has a tendency to make up fake answers, so always verify results and modify as needed.

Quote from a Beta Tester: "This is really cool stuff! ... I LOVE how it comes up with all the items, costs and notes about them. Such a valuable tool because there are things I would not have thought of or realized, especially if it's a business idea unrelated to anything I've done before."

Business Start Up Costs Template

for Excel and Google SheetsDownload

⤓ Excel (.xlsx)Other Versions

License: Private Use (not for distribution or resale)

Description

This Excel workbook helps you put together an estimate of costs and funding required to start your business. It is pre-populated with expense categories common to many small businesses and home-based businesses, so it can be very useful in helping you identify all of your start-up costs, including many you may not have considered.

Whether you start with the predefind categories or create your own list, begin the costing process by identifying all of the categories unique to your business. You may delete categories that do not apply. For a home business, many of the categories can be removed.

As you add your own costs or expense categories, the template will help you understand whether you have adequate funding. After you have your funding secured and you pull the trigger, use the worksheet to track your actual expenditures to help you keep your costs under control.

As you get your business going, you may want to consider using a more detailed business budget and other financial statements.

Starting a restaurant? This free template also includes a customized start up cost worksheet with many cost categories specific to owning and operating a restaurant. Perfect for helping you capture all of those Restaurant Start-Up Costs.

Starting a franchise, web business or home business? Continue reading below for some help with costs specific to these types of businesses as well as links to other helpful resources.

Start-Up Costs for Different Businesses

Restaurant Business Start-Up Costs

Starting a restaurant can be expensive because of the specialized equipment and facilities that are required. Luckily, there are usually leasing options available for the expensive items and many landlords will work with you on leasehold improvements. Use the Restaurant specific worksheet in the Business Start up Cost Template to help you consider other expenses such as cleaning costs, uniforms, menu development and supplier sourcing costs.

Home Business Startup Costs

The nice thing about a home-based business is that you can forgo many of the typical expenses of a startup. Things like internet, office space, furniture and utilities are already taken care of. Better yet, if you qualify for the home office deduction, you can write some of these items off as business expenses. Simply put $0 in the template or delete the rows for those expenses already covered. If you are starting a home-based internet business, continue on to the next section.

Internet Business Start-up Costs

A web based business may be one of the least expensive businesses to start, especially if you can do the web development work yourself. Use the basic template and decide which expenses apply to you – and delete the rest. You may also want to consider some items not listed, such as custom web page design and development work, custom database development and scripting, search engine optimization (SEO), or advanced hosting services. Also, if your business is retail, don't forget to include all of the referral and usage fees for selling through storefronts like Amazon and Ebay.

Franchise Business Start Up Costs

Our Business Start Up Cost Template will also help you if you are looking for a start-up franchise opportunity or looking for franchises for sale. Along with all of the regular costs of starting a business, the template also includes categories for fixed franchise fees as well as monthly franchise dues and marketing co-op fees. You may also want to check with the franchise corporate offices. Many of them provide tools to help you estimate your start up and operating costs.

How to Use the Business Startup Cost Template

The key to putting together accurate numbers is to get into the details. This requires doing detailed research by calling suppliers and providers, searching the internet and listing any and all costs that may be applicable. Start out with a solid list of cost categories and then research these expenses to get good estimates.

Step 1: Enter Your Funding Sources

List the money you plan to use to start your business—such as personal savings, money from other owners, loans, grants, sale of assets, lines of credit, or investments. This helps you compare your total funding to your estimated costs.

Step 2: Estimate Fixed (One-Time) Startup Costs

Use the Fixed Costs section to enter expenses like tools, equipment, furniture, signage, legal fees, licenses, software purchases, website creation, and initial inventory.

Include a Contingency Fund or Reserve Fund line item to cover unexpected costs. There are always last minute surprise costs and fees. You don't want an unexpected cost to kill your business or stunt its growth.

Include an initial Working Capital line item to fund your normal business operations as you grow. It helps ensure that you have adequate cash flow. Sufficient working capital is needed to allow you to continue to purchase inventory and pay bills while waiting for your first payments.

Step 3: Estimate Monthly Operating Costs

In the Monthly Costs section, enter recurring expenses such as rent, salaries, utilities, insurance, marketing, and software subscriptions.

Step 4: Define the Startup Period

Specify the number of months you'll need to cover operating expenses before your business generates enough income to break even. Multiply monthly costs by this number to estimate total working capital needs.

Step 5: Review Surplus or Deficit

Check the Surplus/Deficit summary at the bottom. If your total funding is less than your total costs, you'll see a deficit — indicating how much more funding you may need.

More Business Startup Expense Tips

- Be aware of common budget busters, including installation fees, permits and licenses, taxes (especially self-employment taxes), business insurance, working capital, and monthly expenses.

- Securing lines of credit can take some time. Be sure to have them in place before they are needed.

- Be aware of credit card processing fees. These can be 2% to 5% of the total.

- Little items may not seem like much, but they can add up quickly. Don’t overlook them.

- Business Startup Costs are only part of the financials that any new business owner should put together. Consider putting together a proforma cash flow statement and balance sheet.

- If you are searching for funding, odds are you will need a business plan. Business plans can be a great way to concentrate your thoughts and to really put together a game winning strategy as well as get feedback from mentors and associates.

References and Resources

Startup Costs, Loans and Grants

- Estimating Startup Costs at sba.gov - Information on estimating start up costs from the U.S. Small Business Administration (SBA) office.

- Small Business Loans and Grants at sba.gov - Information and assistance on understanding the various Business Startup Loans and Start up Business Grants available to small businesses.

- Official Site of U.S. Grants - Official site for finding and applying for U.S. Grants including Business Startup Grants.

How to Start a Business

- Starting and Managing a Business at sba.gov - Helpful information from the SBA on starting and managing a business.

- Starting a Business at entrepreneur.com - Many different articles and tips on starting your own business.

- 10 Steps to Starting a Business at business.gov - Detailed information from the U.S. Government on the 10 steps for starting a business.

- Writing a Business Plan at sba.gov - SBA information about how to put a solid business startup plan together.

Small Business Info and Assistance

- Online and face-to-face Mentoring at SCORE - SCORE,a non-profit organization, partners with the SBA to educate entrepreneurs and help small businesses.

- Minority Business Development Agency at mbda.gov- Tools, information and help for those starting Minority Owned Businesses.