Income Statement Template

An income statement or profit and loss statement is an essential financial statement where the key value reported is known as Net Income. The statement summarizes a company's revenues and business expenses to provide the big picture of the financial performance of a company over time. The income statement is typically used in combination with a balance sheet statement.

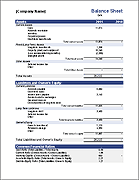

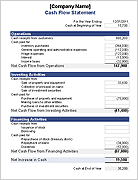

There are many ways to format an income statement. The two examples provided in the template are meant mainly for small service-oriented businesses or retail companies. (1) The simplified "single-step" income statement groups all of the revenues and expenses, except the income tax expense. (2) The "multi-step" income statement example breaks out the Gross Profit and Operating Income as separate lines. It first calculates the Gross Profit by subtracting Cost of Goods Sold from Net Sales. It calculates the Operating Income and then adjusts for interest expense and income tax to give the Income from Continuing Operations.

If all of those terms are making you queasy, read below the download block for more information.

Income Statement

Download

⤓ Excel (.xlsx)Other Versions

License: Private Use (not for distribution or resale)

Description

This income statement template was designed for the small-business owner and contains two example income statements, each on a separate worksheet tab (see the screenshots). The first is a simple single-step income statement with all revenues and expenses lumped together.

The second worksheet, shown on the right, is a multi-step income statement that calculates Gross Profit and Operating Income.

Income Statement Essentials

Net Income = Total Revenue - Total Expenses

Revenues

The income that is generated by providing a service, selling a product, earning interest on investments, renting extra office space, licensing technologies, selling advertising space, or licensing the use of your brand name. In the income statement template, there are categories for Sales revenue, Service revenue, Interest revenue, and Other revenue. You will likely want to customize the Revenue section to highlight your company's main sources of revenue.

Cost of Goods Sold (COGS)

For a retail company, one of the main expenses is the cost of goods sold. So, you'll see Cost of Goods Sold broken out into its own section, with Gross Profit calculated as the Net Sales minus Cost of Goods Sold. Use the MultiStep worksheet in this case.

The cost of goods sold can be calculated by adding beginning inventory, goods purchased, raw materials and direct labor for goods manufactured, and then subtracting the ending inventory.

For service businesses, COGS might not be such a large factor, so that is why the SingleStep worksheet doesn't have a separate COGS section.

Operating Expenses

This section is where you include all your operating expenses such as advertising, salaries, rent, utilities, insurance, legal fees, accounting fees, supplies, research and development costs, maintenance, etc. Don't include interest expense and income taxes (they will be included later).

Operating Income (EBIT)

In the multi-step income statement, the operating income is calculated as the Gross Profit minus the total Operating Expenses. In general, interest expense and income tax expense are not included as operating expenses, which gives rise to the term EBIT or "earnings before interest and taxes" - another name for Operating Income.

Income from Continuing Operations

This is the "bottom line", calculated as the Operating Income minus interest expense and income tax (and plus/minus non-operating revenues, expenses, gains, and losses, if there are any). If there are no "below-the-line" items, then this is the same as the Net Income.

Below-the-line Items

Some forms of income, such as the sale of a building you are no longer going to be using, are included "below-the-line" (i.e. below the reported Net Income from Continuing Operations) because they may not be expected to occur in the future. These include the effect of accounting changes, income from discontinued operations, and extraordinary items (gaines or losses that are unusual or highly abnormal).

Income Statement References:

- Financial Accounting: Reporting and Analysis by M.A. Diamond, E. K. Slice, and J.D. Slice., 2000.

- Income Statement, Net Income or "Bottom Line" at wikipedia.org